voluntary life and ad&d child

Voluntary LifeADD Customer Service. Children can be added to the coverage at anytime without.

Voluntary Term Life And Ad Amp D Insurance Mutual Of Omaha

1 Employers have an important role to play to give families the protection they need and we are your best partner for group and voluntary life.

. Your cost for child life coverage is the same no matter how many eligible children you insure. Child coverage amount up to 15K Standard is 10K. Option 2 Under 6 months 2000.

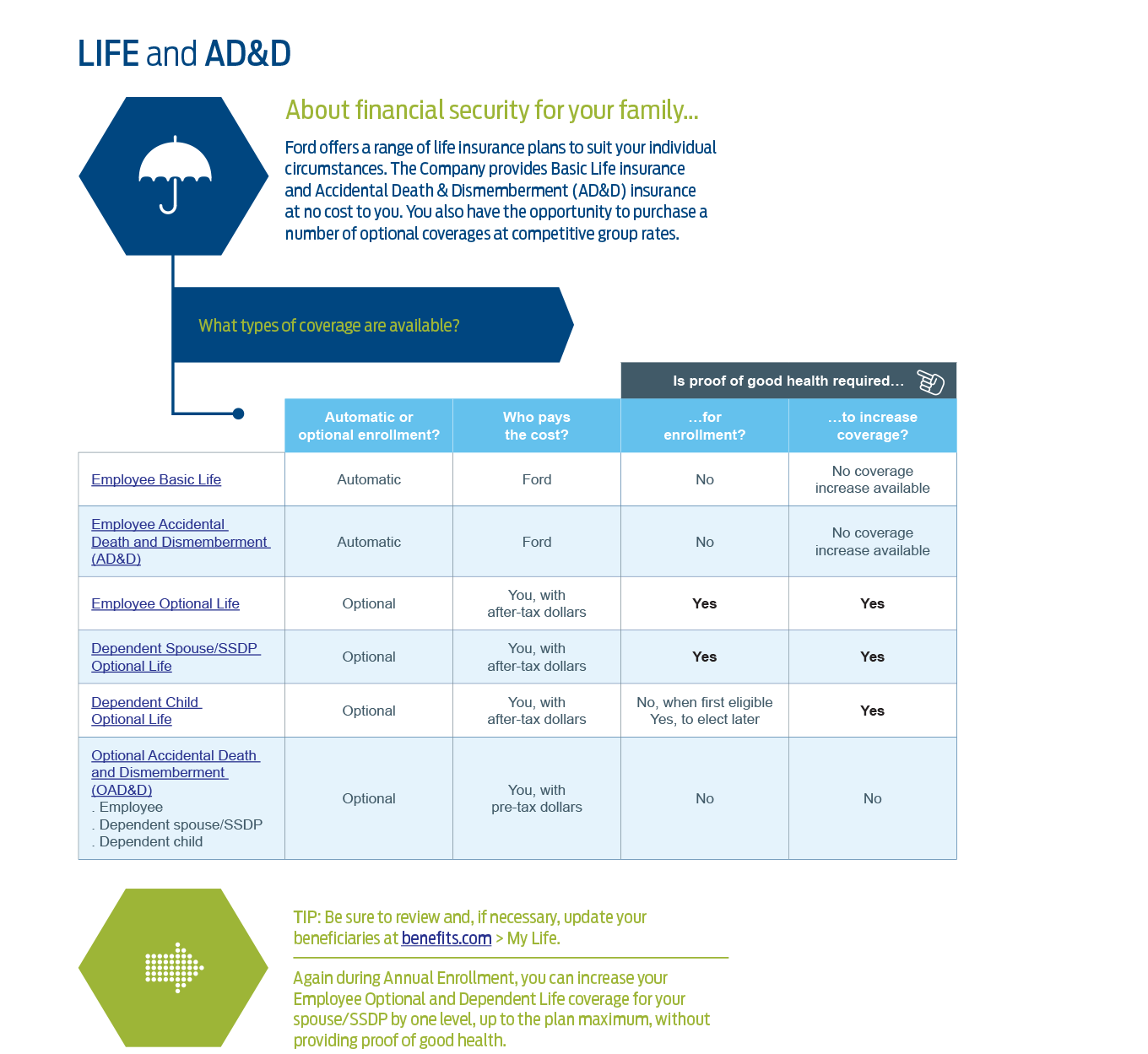

Life and ADD insurance. If youre young and unable to qualify for good rates from an insurer whether its due to a preexisting medical condition or another issue voluntary life. Instead she should purchase hisher own Optional Life Insurance.

Child life and ADD options are available at 5000 10000 15000 or 20000. ADD insurance pays a benefit if you die or are seriously injured as the result of an accident. What is voluntary Child life and ADD.

The employee pays the monthly premium to the insurance company offering the policy. Eligible employees and dependents can elect up to the following Guaranteed. Learn More About Your Options.

Voluntary life insurance is an employee benefit option offered by many employers to their employees. Voluntary Life and ADD. As with any type of life insurance plan voluntary life and ADD is a financial tool that provides a sum of money to your beneficiary upon your death.

Ad. Dependent coverage is contingent on you having Voluntary Life. They provide you with the ability to make sure that your family will be financially secure if you happen to pass away.

Your cost for voluntary ADD coverage is paid on a pre-tax basis. With Life and Accidental Death and Dismemberment ADD Insurance you can help them prepare for the unexpected and give them the confidence to live life to its fullest knowing their loved ones will be protected. Did you know just 54 of Americans had life insurance coverage in 2020.

The partner may not be covered by the SpouseDP life insurance plan. Flexible Life Insurance for Businesses. Voluntary ADD coverage amount up to 5000 per year for a maximum of 5 years to your covered dependent child who is enrolled in a legally licensed child care center.

In addition to the basic ADD insurance coverage provided by HSHS you can purchase more coverage separate from life insurance for you and for your family through Securian. Eligible County employees in all bargaining units have the option to purchase additional life insurance for themselves their spouse or their dependent children. Coverage options and cost Coverage amounts are multiplied and then rounded to the next higher 1000.

Enhanced Employee ADD 100 of Life benefit to 500000 Spouse and Children Benefits available once Employee selects Voluntary Benefit Spouse Benefit 20000 to 250000 in 10000 increments not to exceed 100 of Employees amount Guarantee Issue. INCREASED DEPENDENT CHILD BENEFIT The voluntary ADD benefit amount will be increased to 50 percent of your voluntary ADD amount up to 20000 if. In a full-time position.

Voluntary Accidental Death and Dismemberment VADD is an affordable limited form of life insurance that provides a cash benefit in the event of a fatal or disabling accident. Accidental Death Dismemberment insurance policies ADD provide benefits for covered accidents that result in fatality paralysis the loss of a limb eyesight hearing speech and more. 30000 Child Benefit 2500 5000 10000 not to exceed 10 of Employees amount Guarantee Issue.

Voluntary accidental death and dismemberment insurance or voluntary ad d insurance is often offered by employers similar to voluntary life insurance. Voluntary child add insurance. Accidental death and dismemberment coverage for employees only is included in the UNC Voluntary Life Insurance Plan at no additional cost.

The premium amount will be automatically deducted from your paycheck. Its more important than ever to help employees protect their families. Voluntary life insurance is a financial protection plan that provides a cash benefit to a beneficiary upon the death of the insured.

A child may not be covered by more than one employee. If a spousedomestic partner is in a Carnegie Mellon benefits-eligible position. We can help employers choose the life insurance plan that best suits their employees needs.

An employee is best protected when they have access to both Life and ADD. You may purchase coverage just for yourself or for you and your family. Coverage can continue past the 26 th birthday for children qualified as disabled.

Children under the age of 26 may be covered by dependent child life and ADD insurance. Children can remain covered until their 26th birthday. Peralta CCD and Voya will have a Voluntary Life ADD Open Enrollment from September 2 through September 30 2021.

To purchase voluntary life and ADD you must enroll within 31 days of your hire date. An ADD plan may include coverage for employees only or employees and dependents and typically provides 24-hour coverage no matter where a covered accident. The benefit is a flat 10000 per child.

6 months and older 5000. Like any other life insurance program voluntary life insurance doles out a payment or death benefit to the beneficiary in your plan upon your death. Voluntary life insurance and accidental death and dismemberment ADD policies are offered to employees as part of a companys benefits plan and you can typically purchase coverage for yourself your spouse or your children.

This is a great opportunity to sign up for additional Life ADD up to the guaranteed issue amounts with no medical questions for you spouse and child dependents. 6 months and older 10000. You may only apply for.

Percentage of your Voluntary ADD insurance as follows. Eligible Dependent Child Coverage options are. Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage.

Employee coverage face amounts of 25K to 250K in increments of 25K with no salary multiplier. An employees loved ones depend on them. Voluntary group accidental death and dismemberment ADD insurance is a simple way for employees to supplement their life insurance coverage with additional protection if they or a family member dies or is dismembered as a result of a covered accident.

Option 1 Under 6 months 1000. Child life and add options are available at 5000 10000 15000 or 20000. Voluntary Accidental Death Dismemberment ADD Coverage.

Spouse coverage amount up to 100 of the employee amount. SpouseDomestic Partner only 60 percent of your coverage Children only 15 percent of your coverage for each child.

Ad D Vs Accident Insurance As We Always Point Out In Axis Capital Group Accidents Can Always Happen When You Least Expect It But Accident Insurance Ads Axis

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

What Is Voluntary Life And Ad D Insurance Sensational Things About Life Insurance Let Us Talk Finance

What Is Voluntary Term Life Insurance The Essential Life Hacks For Beginners Let Us Talk Finance