regional income tax agency estimated payments

RITA PO Box 89475 Cleveland OH 44101 - 6475. 2018 Estimated Tax Payment not less than 14 of Total Estimate 00 3.

City Income Tax North Canton Oh

Form 32 EST-EXT.

. If your estimated payments are either less than 90 of the tax due or not equal to or greater than your prior years total tax liability you will be subject to penalty and interest. Payments made by check or via ACH will not incur this service charge. Total Estimated Tax Due 00 4.

Estimated Income Tax andor Extension of Time to File. Estimated Payment not less than 14 of Line 3 00 Note. Were Hiring See Our Open Positions.

Line 1 must equal Line 6 2Less Prior Year Credit 00 3. RITA PO Box 94582-4582 Cleveland OH 44101 - 4582. 440 526-0900 Brecksville Office Fax.

If you dont use the portal there is a form that you can fill out and mail in. Make check payable to RITA. Individual Estimated Income Tax andor Extension of Time to File.

Total Estimated Tax distribute to each applicable municipality in Line 5 00 Note. RITA PO Box 94652 Cleveland OH 44101 - 4652. Use the Message Center to Send Us a Secure Email.

Leave in the drop-box at the Township Administration Building 455 Hoes Lane and Piscataway. Electronically using the links shown in the column on the left. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year.

Individuals - Online Services MyAccount - Regional Income Tax Agency. See below for mailing address. The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on pages 7-8 of these instructions.

Request for Allocation of Payments. Average Regional Income Tax Agency hourly pay ranges from approximately 1161 per hour for Data Entry Clerk to 2443 per hour for Paralegal. Self-service phone options such as making a payment checking refunds and estimates are available around the clock or you may speak with an agent during business hours 800 am - 500 pm Monday - Friday.

29 out of 5 stars. Amy Arrighi Named Executive Director at RITA. Amy Arrighi Named Executive Director at RITA.

3 rd Quarter - September 15 th. RITA offers comprehensive tax collection from registration through litigation. REGIONAL INCOME TAX AGENCY.

Regional Income Tax Agency. If you believe youll have to pay more than 200 in income taxes for a calendar year youre required to pay estimated quarterly taxes. The organization urges residents to use the My Account portal to pay quarterly taxes.

The Regional Income Tax Agency known as RITA was formed in 1971 to administer 1. The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on page 8 of these instructions. Regular mail through the post office.

Form 32 EST-EXT. Beginning with tax year 2016 Ohio law requires you to make estimated municipal income tax payments if you will owe 20000 or more to an Ohio municipality. Self-Service Phone Options - Making a Payment Checking Refunds and Estimates - Available 247.

CLEVELAND OH 44101-4582. Individuals - Payment Options - Regional Income Tax Agency. Were Hiring See Our Open Positions.

When figuring your estimated tax for the current year it may be helpful to use your income deductions and credits for the prior year as a starting point. Self-Service Phone Options - Making a Payment Checking Refunds and Estimates - Available 247. Select form type Tax Penalty and Interest Billing Statement then Next.

Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Form 37 Instructions Worksheet 2 may be used to calculate your Estimated Income Tax Liability. Use the Message Center to Send Us a Secure Email.

Amount Paid Add Lines 1 and 2 00 make check payable to RITA see page 2 for mailing address 4. Reconciliation of Income Tax Withheld and W2 Transmittal. Application for Municipal Income Tax Refund.

Regional Income Tax Agency RITA LinkedIn. To determine whether your municipality required estimated tax payments for tax years prior to 2016 please visit the RITA Municipalities page click on your municipality and review the Special Notes section for those. REGIONAL INCOME TAX AGENCY REGIONAL INCOME TAX AGENCY.

Use this form to allocate existing paymentscredits between separate individual accounts. 4 th Quarter - January 15 th. There is a transaction fee of 290 for credit card transactions.

See below for mailing address. For Tax Year 2018 through 2021 estimated payments are due quarterly COVID-19 related extended due dates are as noted below. Form 27 Net Profit Tax Return.

Allocate to applicable RITA Municipalities Balance Due. For Tax Year 2021 the due date for the 1st quarter estimate was April 15 2021. Beginning with tax year 2016 Ohio law requires you to make estimated municipal income tax payments if you will owe 20000 or more to an Ohio municipality.

1 st Quarter - April 15 th 2 nd Quarter - June 15 th. Average Regional Income Tax Agency hourly pay ranges from approximately 1161 per hour for Data Entry Clerk to 2443 per hour for Paralegal. ACH payments using your checking accounts do not incur transaction fees.

RITA Welcomes New Members Beginning July 1st. RITA PO Box 94582 Cleveland OH 44101 - 4582. Select your City Code TAB set Period End to 1220 Description to 20 Form Type to 98 enter amounts you are paying for Tax Due Penalty and Interest check box to sign and File to continue the payment process.

5 REGIONAL INCOME TAX AGENCY Estimated Income Tax andor Extension of Time to File SSN. Use this form to allocate existing paymentscredits. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online.

Routine System Maintenance July 23 27 30. Request for Allocation of Payments. Estimated Payment not less than 14 of Line 3 00 Note.

Routine System Maintenance July 23 27 30. Tax Refunds 1. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate.

See News and Important Updates for. Form 20 - EXT Net Profit Estimated Income Tax andor Extension of Time to File. Use your prior years federal tax return as a.

Ohio Regional Income Tax Return Rita Support

Cities Brace For Tax Refund Requests From Employees Working At Home

When Are Taxes Due In 2022 Forbes Advisor

Solon Municipal Income Tax Solon Oh Official Website

The Lakefront City City Of Euclid

Individuals Filing Due Dates Regional Income Tax Agency

![]()

The Regional Council Of Governments Regional Income Tax Agency

Canadian Tax News And Covid 19 Updates Archive

Income Tax City Of Gahanna Ohio

![]()

Business Faqs Net Profit Estimates Regional Income Tax Agency

Cities Brace For Tax Refund Requests From Employees Working At Home

![]()

The Regional Council Of Governments Regional Income Tax Agency

![]()

Individuals Estimated Tax Payments Regional Income Tax Agency

Finance And Income Tax Waterville Ohio

![]()

The Regional Council Of Governments Regional Income Tax Agency

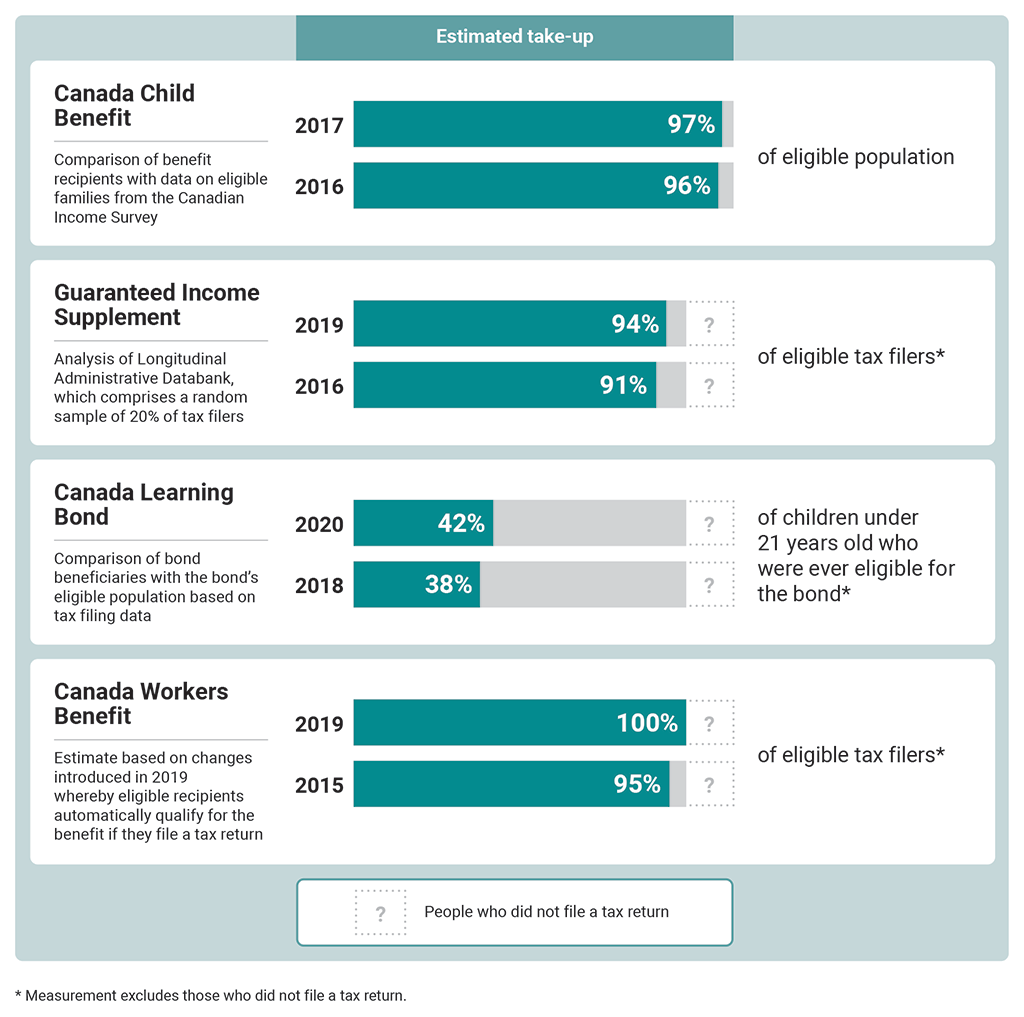

Report 1 Access To Benefits For Hard To Reach Populations

![]()

Individuals Estimated Tax Payments Regional Income Tax Agency